Strategy Back Tester

-

AdminKeymaster4 months, 3 weeks ago #5427

AdminKeymaster4 months, 3 weeks ago #5427BackTest XAUUSD

The most important strategy to find the best and most profitable settings of any strategy based on the recorded ticks.What you need to do to get a high-quality set to work on a live account:

1. Record quotes of the traded symbol

2. Launching a “trial” trading on a real account

3. Preparing the Backtest strategy for launch

4. Work on creating a set

This is a roadmap for creating a working set. If you have done everything according to the instructions, but the profit does not go to the broker, then most likely the broker’s conditions do not allow you to trade with the arbitration system.

1. Record quotes of the traded symbol

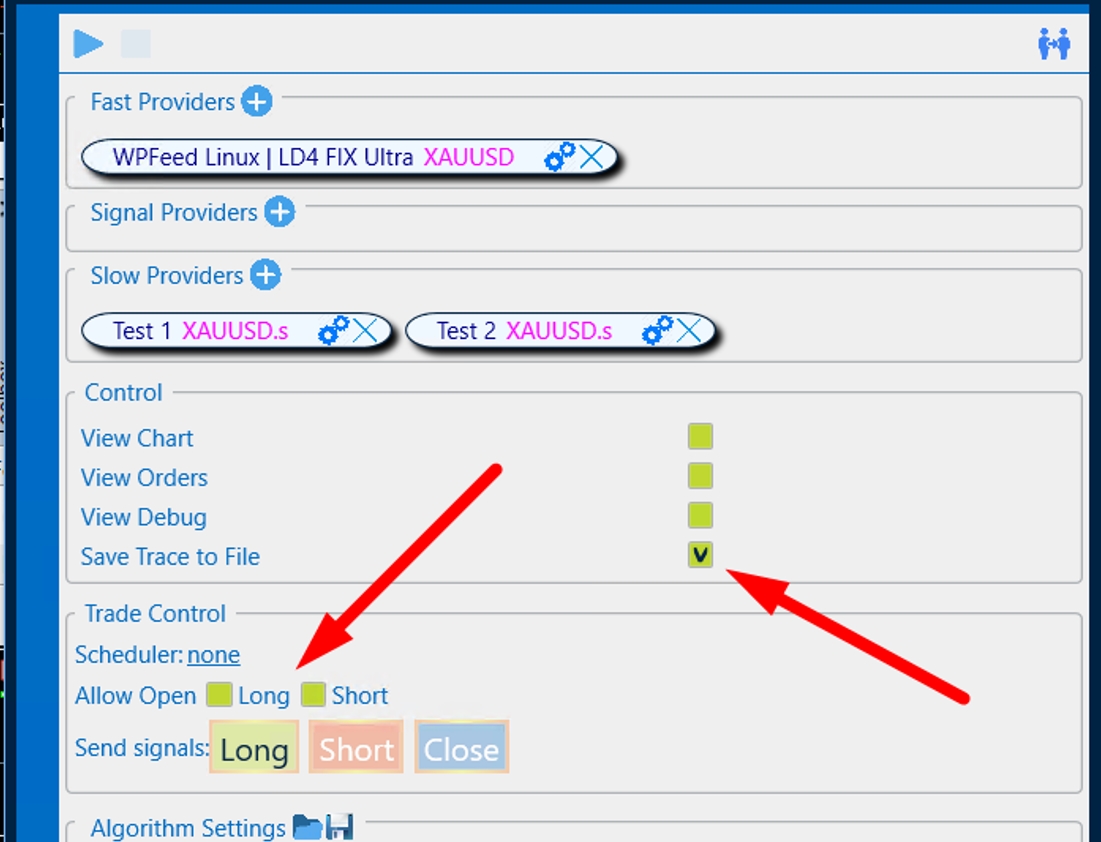

To start recording quotes, check the Save Track to File box in the selected strategy and run it (you can do it without trading permission). We recommend recording an entire trading session, and at least 3 days for a better result.

After launching the strategy, quotes will be automatically recorded in a separate file with the name of the strategy that you are recording. When the required time is recorded, stop the strategy and now you can move on to the next points.

2. Launching a “trial” trading on a real account

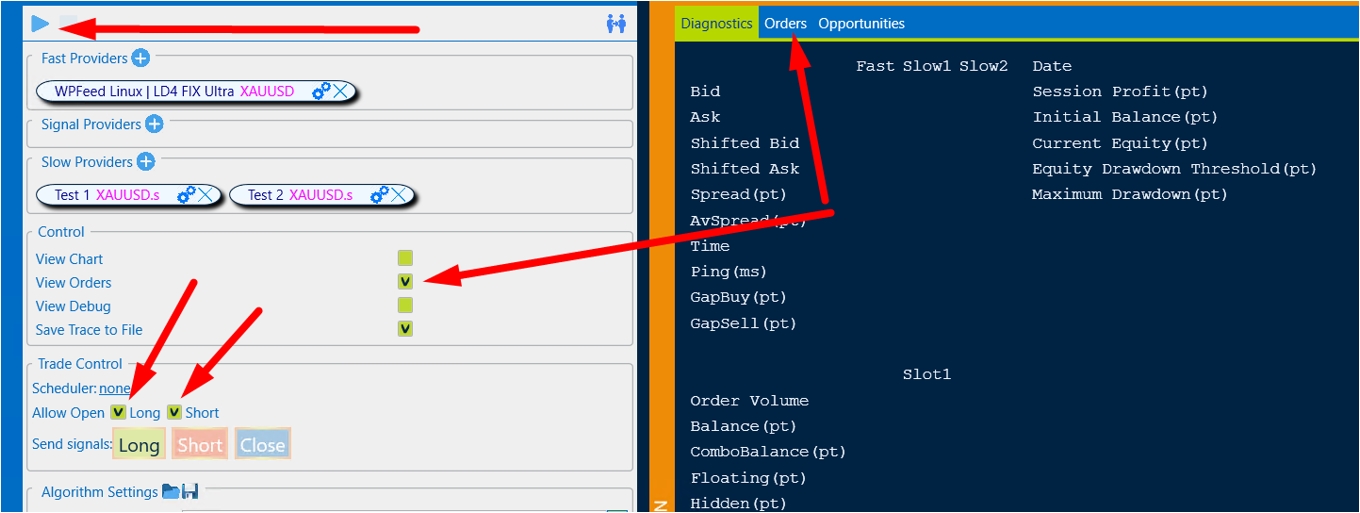

Launch the strategy on a live account with the desired symbol, allow trading, and be sure to add the View Orders checkmark.

It is important to check the lot size before launching on a real strategy (always conduct tests with a minimum), the size of the chip should be small for a set of statistics.

For example, to test on Gold (XAUUSD), you can use the following “Basic” settings:

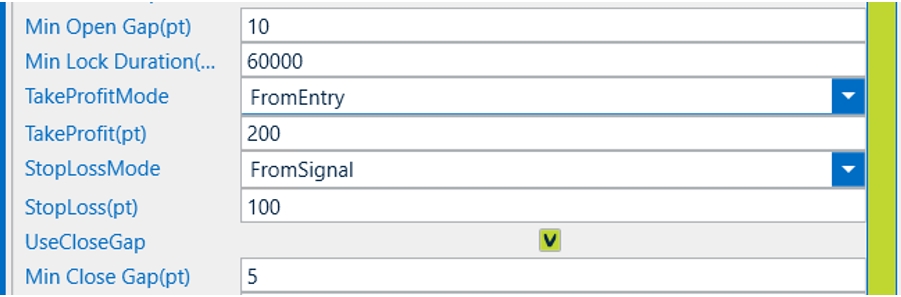

To test on Gold:

- Open gap = 10;

- Close the gap = 5;

- Take profit = 200;

- Stop loss = 100.

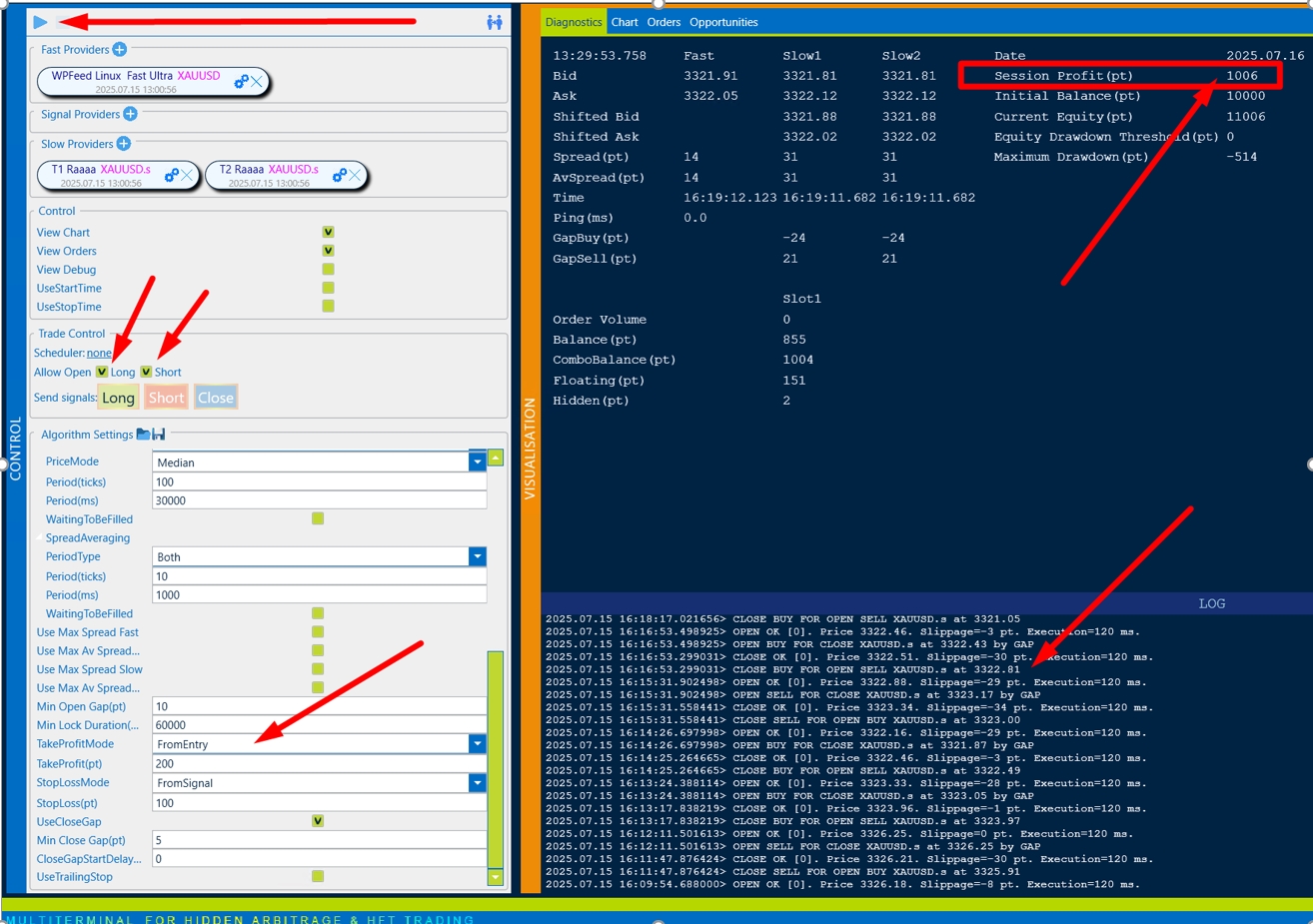

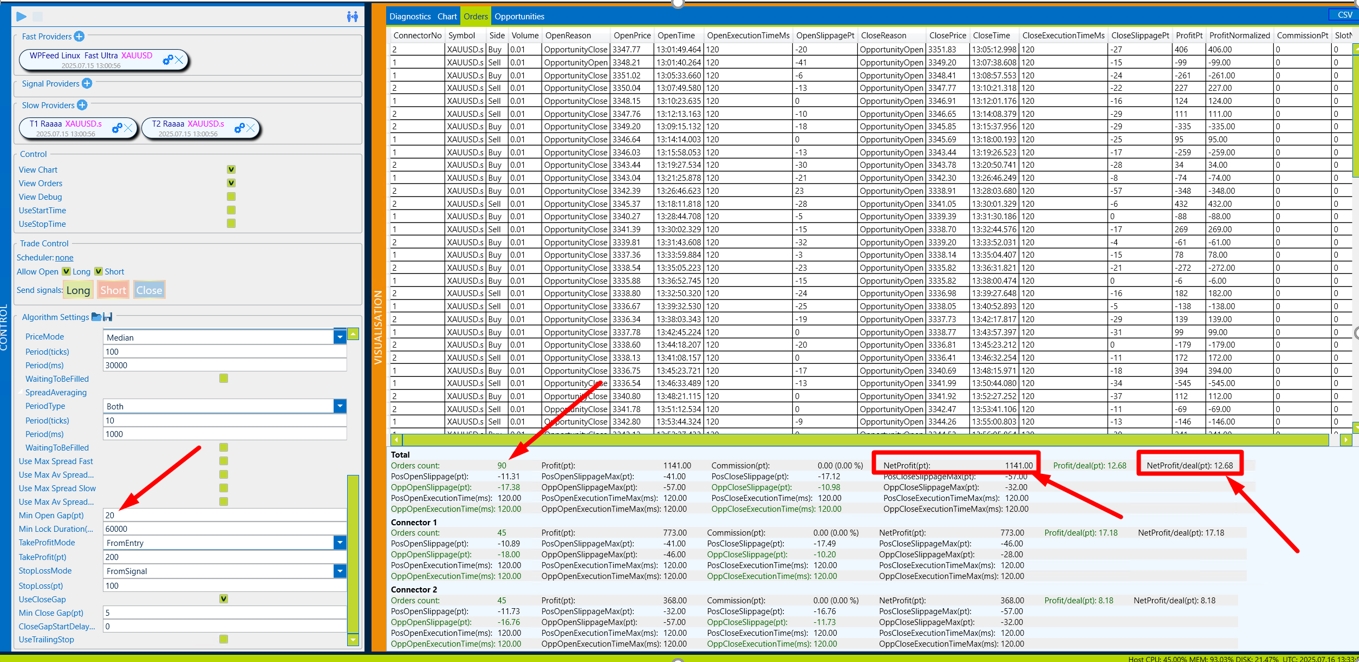

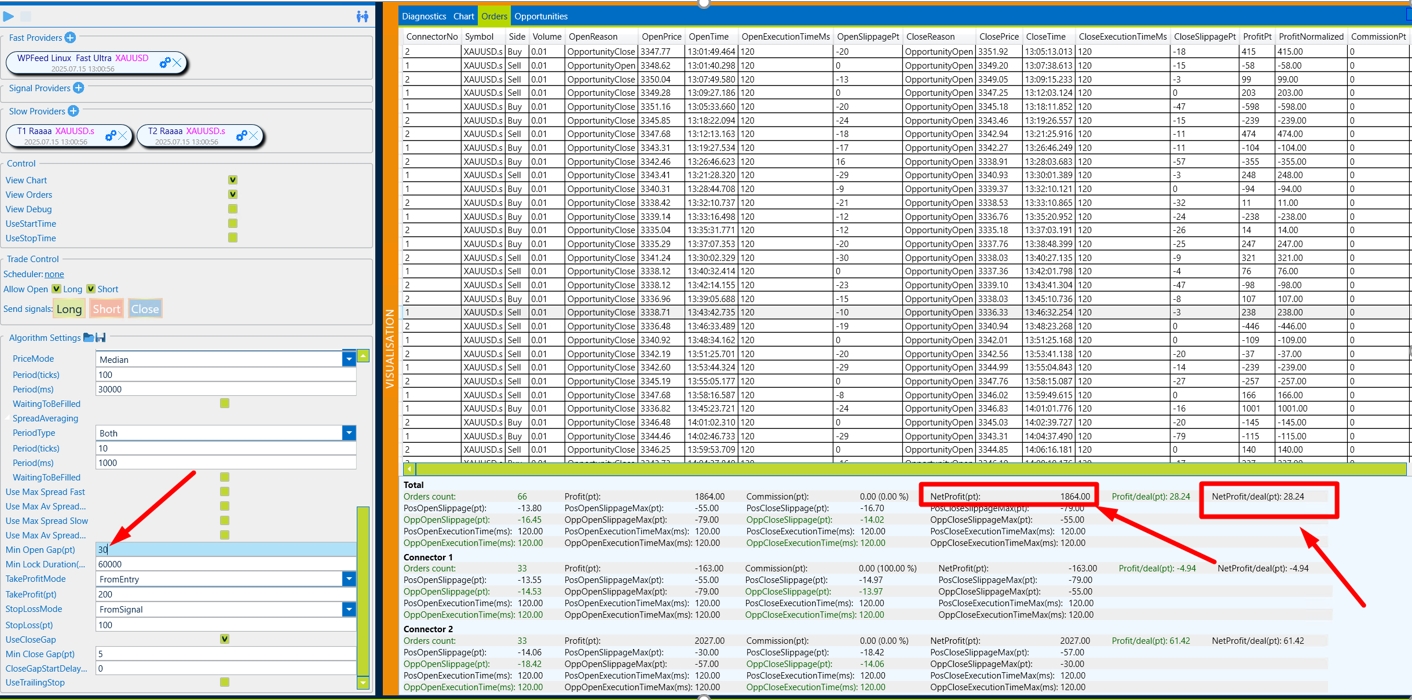

We are waiting for 5-10 transactions to be executed. Then Stop the strategy and go to the Orders section.

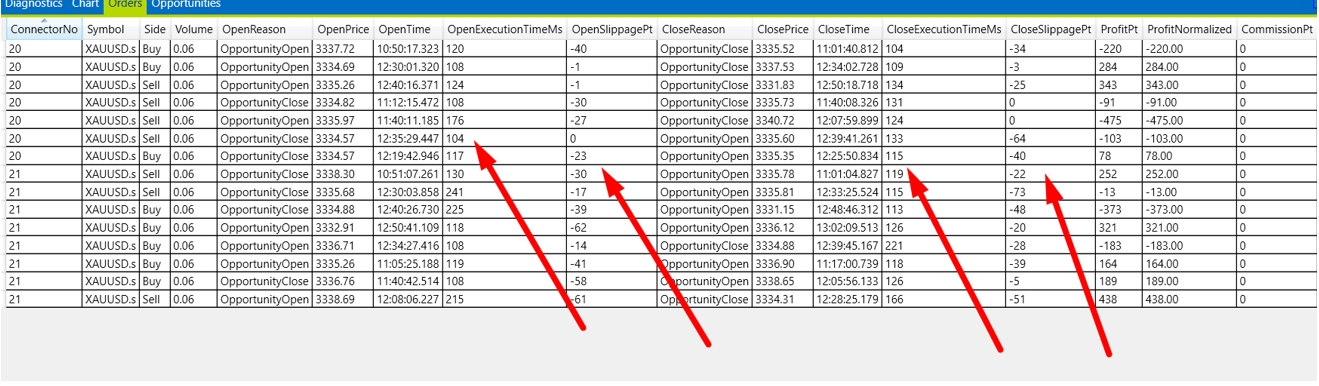

Important parameters for the Backtest that need to be recorded:

- average OpenExecutionTime, in this case, you can record 120ms;

- average CloseExecutionTime, in this case, you can record also 120ms;

- average OpenSlippagePT in this case, you can record 30pt;

- average CloseSlippagePT in this case, you can record also 30pt.

It is also important to pay attention to the number of open/closed transactions with a slip = 0. In our case, we can safely put a 20% probability in the Backtest.

Now we have all the data to start creating a working set.

3. Preparing the Backtest strategy for launch

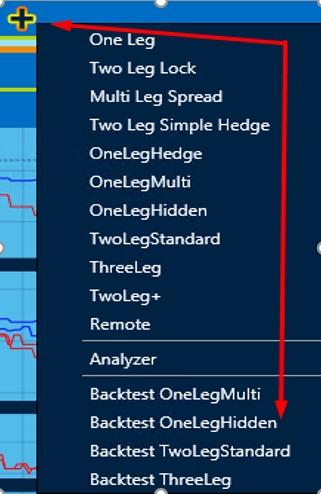

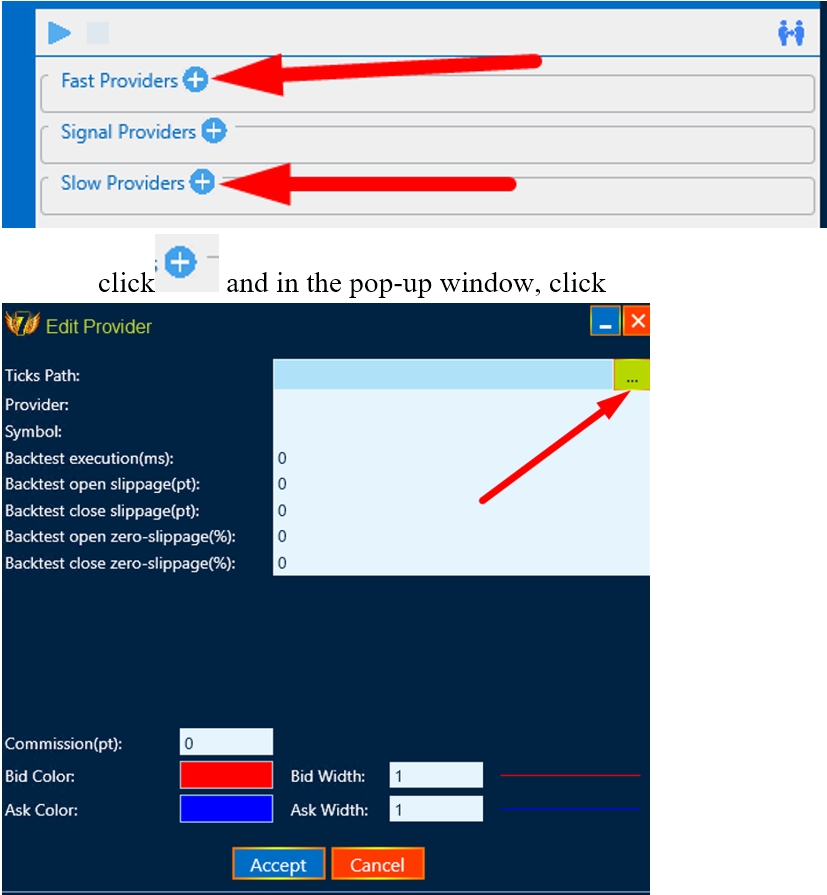

To do this, click and select the hidden history testing strategy click and choose the Backtest OneLegHidden strategy:

Next, the following actions will be required:

- downloading previously recorded quotes for Fast Providers;

- loading previously recorded quotes for Slow provider.

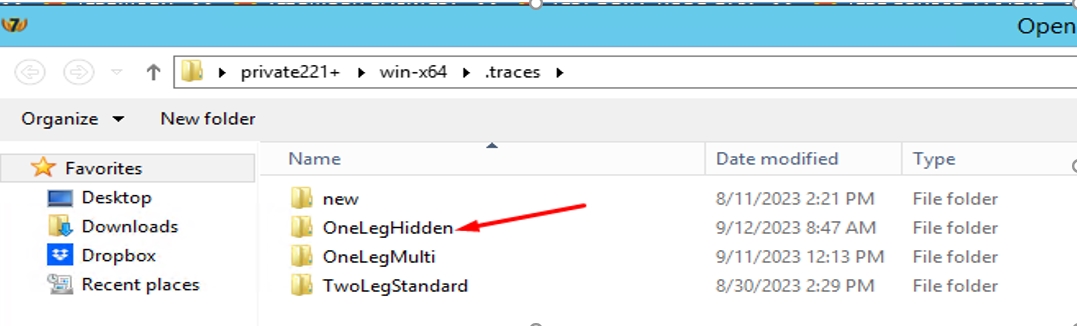

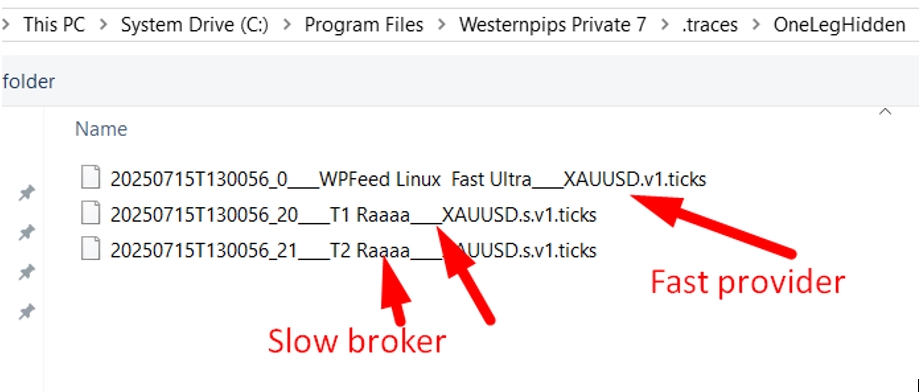

we choose a strategy whose quotes were recorded:

And we select quotes step by step for Fast providers, and then for Slow providers:

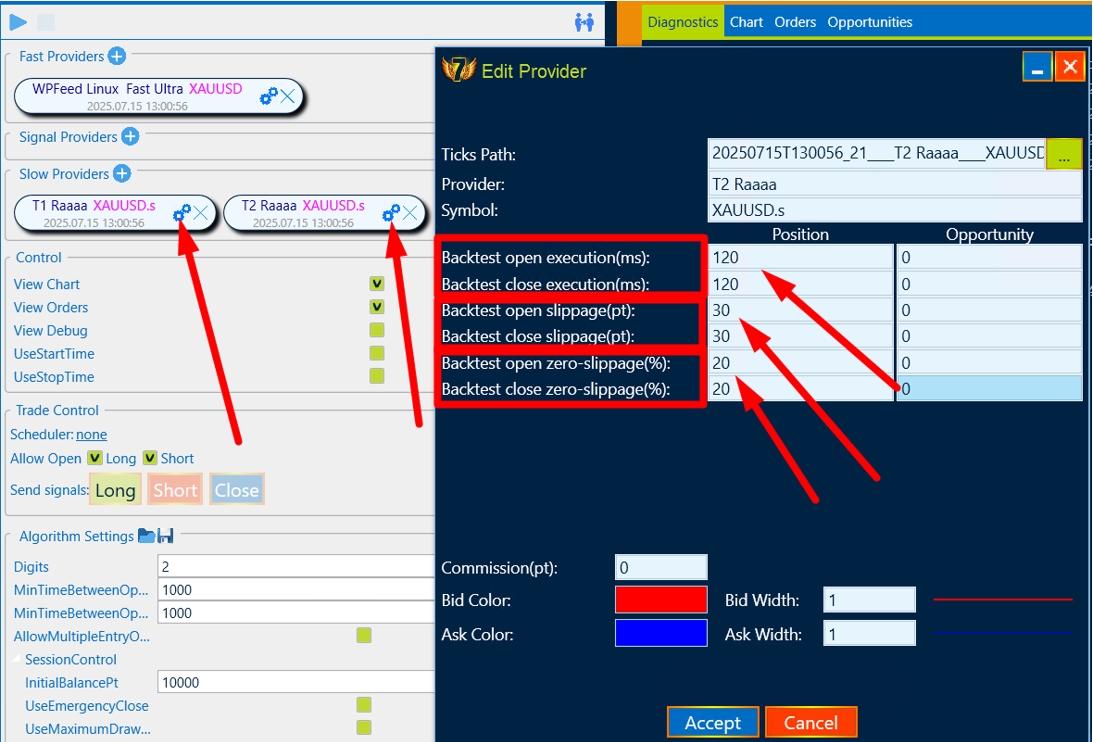

It is necessary to set the data that we received from testing on a real account in the settings of the slow provider. As we remember, we recorded the opening and closing of a deal as =120ms, the slip = 30pt, and the probability of opening/closing a deal with a slip = 0 is 20%.

We fill in this data in the settings of BOTH brokers (we do the same if the broker is the same)

Please note that the OneLegHidden strategy requires 2 “slow” brokers and 1 “fast” broker, so there will be 3 entries in total.

If the quotes are loaded correctly, the following type of program will appear:

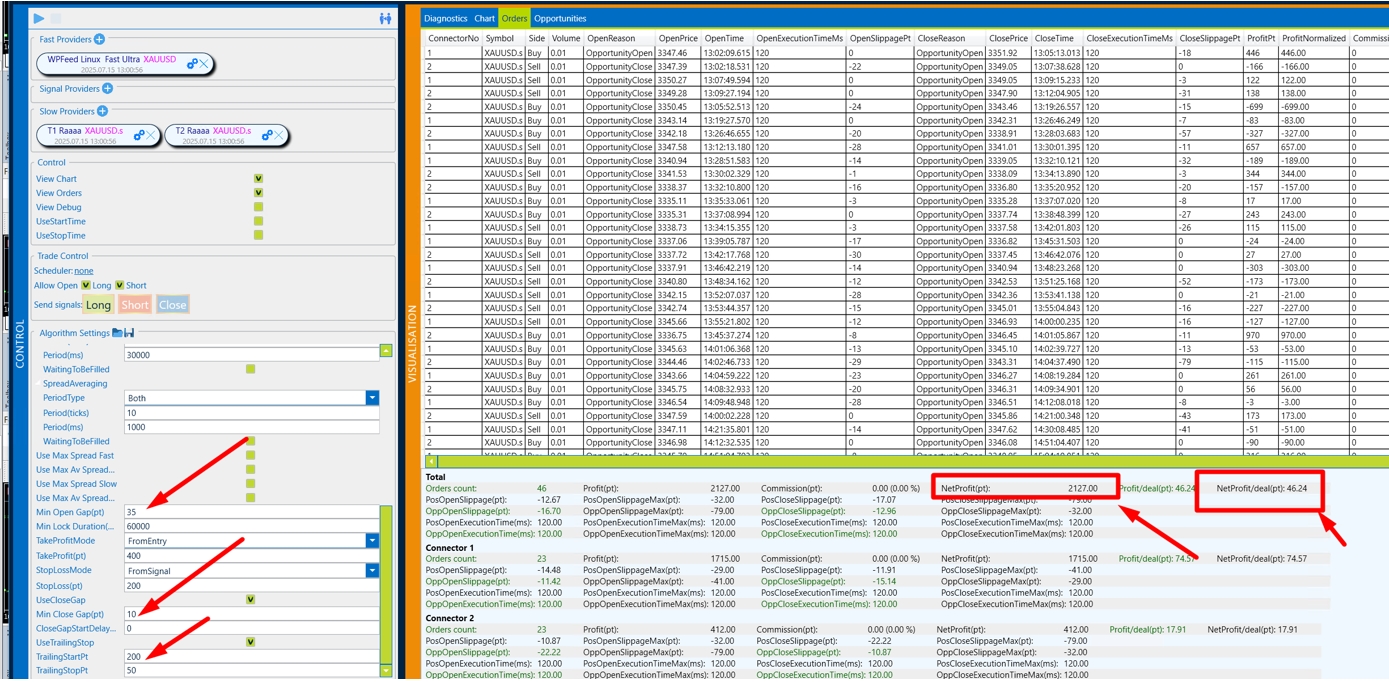

We can start testing with the “Basic” settings:

- Open a gap = 10;

- Close the gap = 5;

- Take profit = 200;

- Stop loss = 100.

4. Work on creating a set

After preparing the strategy, click start and wait for the result.

We recommend that you configure the set in the Orders section:

The most important parameters of:

- NetProfit/deal (pt) – shows the average profit per transaction, taking into account all profitable transactions and unprofitable ones.

- NetProfit(pt) – total profit with current settings

Please also note that the data that we entered into the backtest is now fully reflected in the Backtest- Open/CloseExecutionTime, Slippage and the probability of slipping = 0 is approximately 20%. This is the right testing strategy.

Now our task is to increase the profit on the transaction and the final profit.

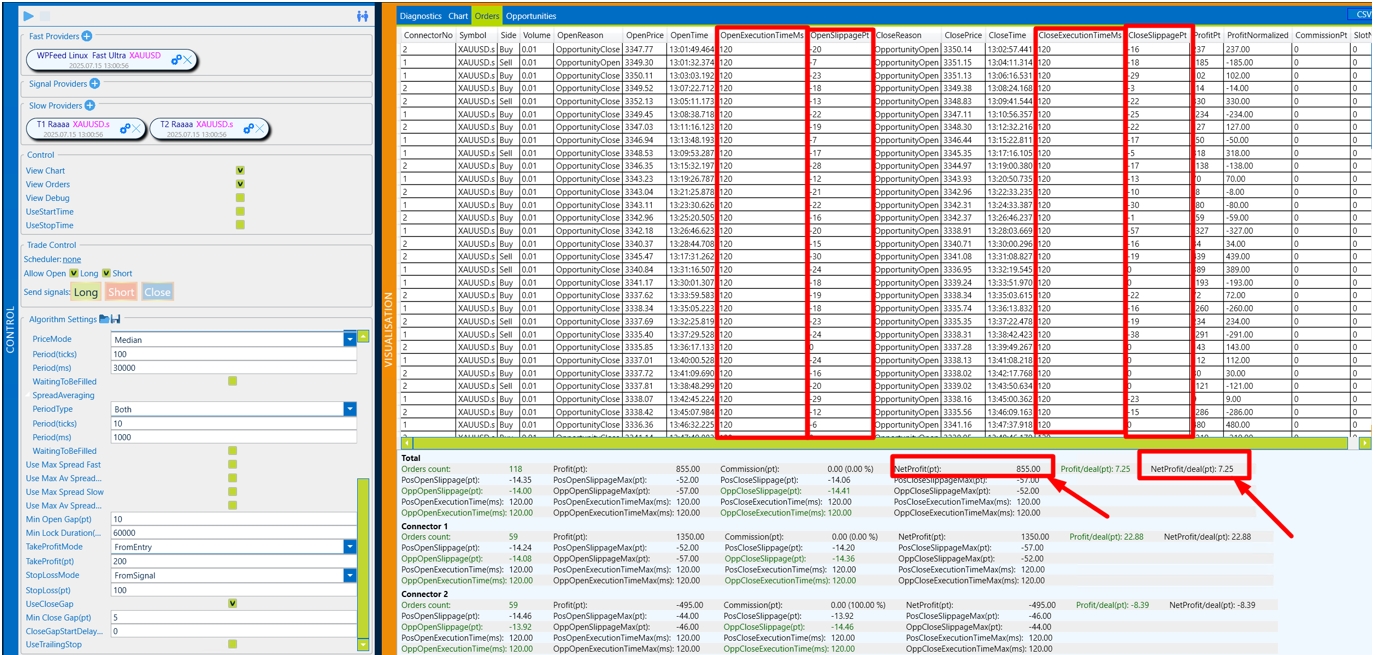

The first is to upgrade OpenGap by 10 and let’s start the strategy again.

We see that the profit per transaction has become higher, the total profit has also increased and the number of transactions has decreased.

We raise it by 10 more OpenGap and let’s start the strategy again.

We see that in just 2 steps of the Backtest, we increased the profit from 7p per trade to 28p, i.e. the profit margin of the strategy became 4 times better.

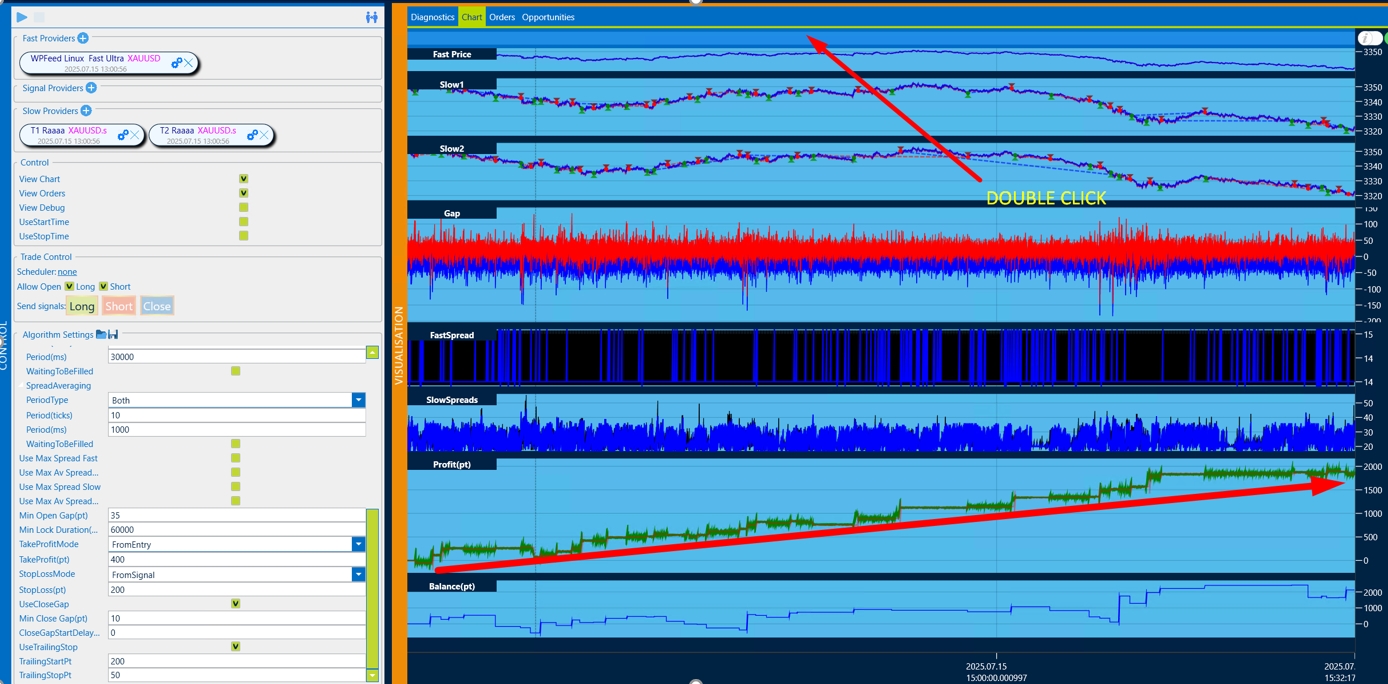

After 20 minutes of the test, the perfect set appeared for the recorded quotes.

Check the quality and reliability of the signal in the Chart column.

We recommend the following configuration sequence:

- Open Gap – we find the biggest profit per trade and total profit.

- CloseGap – Just like with the opening of Gap, we are looking for the most profitable setup.

- TakeProfit/StopLoss – There are many options here, it is necessary to painstakingly search for the ideal option.

- TrailStart-TrailStop.

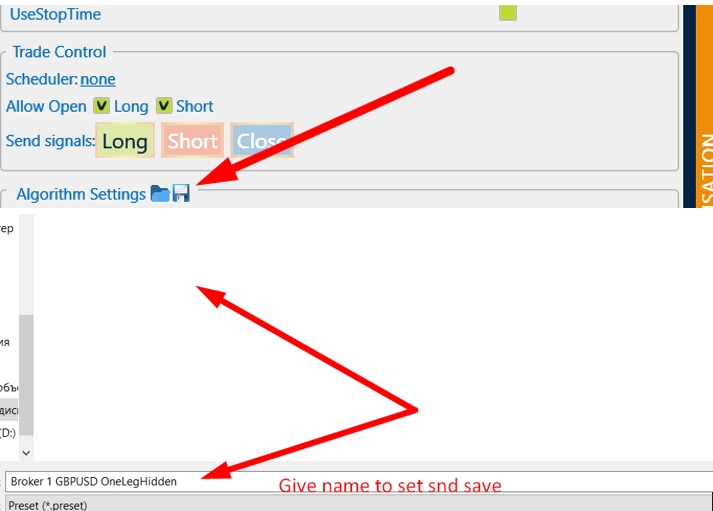

After you have found the most profitable set, you need to write it down.

Pay attention to the gap size on the broker you want to trade on. We recommend setting the gep size not less than the spread size.

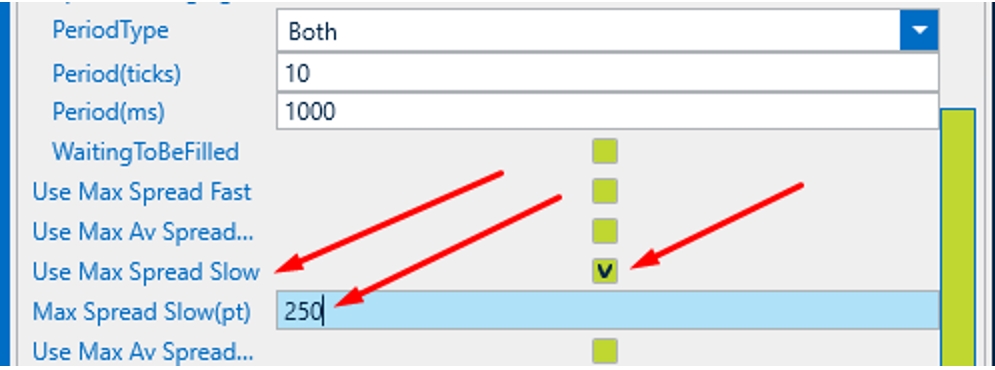

Also note that there is a lot of volatility on big trading news and the spread widens very much on a slow broker. Limit it and you will protect your trading from unnecessary risks.

You must understand that it takes patience and painstaking work to create a set. Record several days of quotes and when creating a set on one day, test it on other days as well. If you see that the profit is very small or the trade is not stable, change the broker.

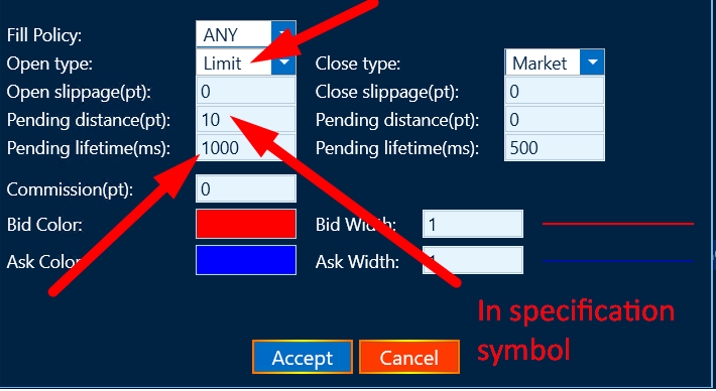

Please note that the software allows you to trade in the limit order mode (for maximum trade concealment, but it is not suitable for all brokers – pay attention to the size of Stop orders in the symbol specification). The lifetime of a limit order is also important. We recommend setting 1000ms.

Limit order testing is not available in the Backtest yet. To trade limit orders, change the order type from Market to Limit

Basic configuration of the strategy

Input data

Parameter Description AllowTradeOpen allow opening orders Digits the number of decimal places in quotes SessionControl InitialBalancePt – Specify the initial deposit UseEmergencyClose – Specify the initial deposit

UseMaximumDrawDown (MaximumDrawdown) – the amount of loss on the strategy in % of the initial deposit at which the software will stop trading.

ExecutionControl If enabled: Treshold(ms) – the exucution time is acceptable for your setup

MaxExecution Count Above Treshold – The number of allowed exceedances before trading stops.

Max Consecutive Execution Count Above – The allowed number of consecutive increases in the threshold before trading stops.

SlippageControlPt If enabled: SlippageControlPt – Acceptable size of the slip

MaxExecution Count Above Treshold – The number of allowed exceedances before trading stops.

Max Consecutive Execution Count Above – The allowed number of consecutive increases in the threshold before trading stops.

Volume1 the volume of the opened transaction on the first slow broker Volume2 the volume of the opened transaction on the second slow broker UseMixer If enabled: Hedging is possible not only on different brokers, but also on one (Buy/sell)

If not Enabled:

There will be no counter orders on the same broker.

UseAutoShift use automatic alignment of quotes between fast and slow broker. AutoShiftPeriod averaging period for automatic alignment of quotes ManualShiftBidPt the number of points to shift the Bid price of a fast broker ManualShiftAskPt the number of points to shift the Ask price of a fast broker MinSpreadFastPt minimum spread in points on a fast broker at which a deal can be opened UseMaxSpreadFast use the maximum spread filter on a fast broker MaxSpreadFastPt the value of the maximum spread filter in points on a fast broker, at which a deal can be opened MinSpreadSlowPt the minimum spread in points on a slow broker at which a deal can be opened UseMaxSpreadSlow use the maximum spread filter on a fast broker MaxSpreadSlowPt the value of the maximum spread filter in points on a slow broker, at which a deal can be opened MinOpenGapPt minimum gap in points for opening a deal on a slow broker FastTickDirectionConfirmation entry only if the direction of the last tick on the fast broker coincides with the direction of the transaction TakeProfitPt take profit in points -From Entry – the profit calculation is based on the opening price of the transact ion

-From Signal – The profit calculation is based on the price that was at the beginning of the signal.

StopLossPt stop loss in points -From Entry – the StopLoss profit calculation is based on the opening price of the transact ion

-From Signal – The StopLoss calculation is based on the price that was at the beginning of the signal.

MinLockDurationMs minimum bow holding time in milliseconds UseCloseGap If enabled: The size of the reverse Gap for closing the transaction.

UseTralingStop If enabled: TralingStartPt – The amount of profit from which traling is enabled

TralingStopPt – The Traling step that the level will move to.

We recommend starting trading on real accounts only after carefully selected sets, taking into account the slippage in the tests.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

-

This reply was modified 4 months, 3 weeks ago by

Admin.

Admin.

You must be logged in to reply to this topic.