Two Leg Standard Algo

-

AdminKeymaster3 months, 2 weeks ago #5499

AdminKeymaster3 months, 2 weeks ago #5499🔄 TwoLegStandard Algorithm — Classic Dual‑Provider Latency Arbitrage Strategy

🧠 Smart Trading Between Two Independent Quote Feeds

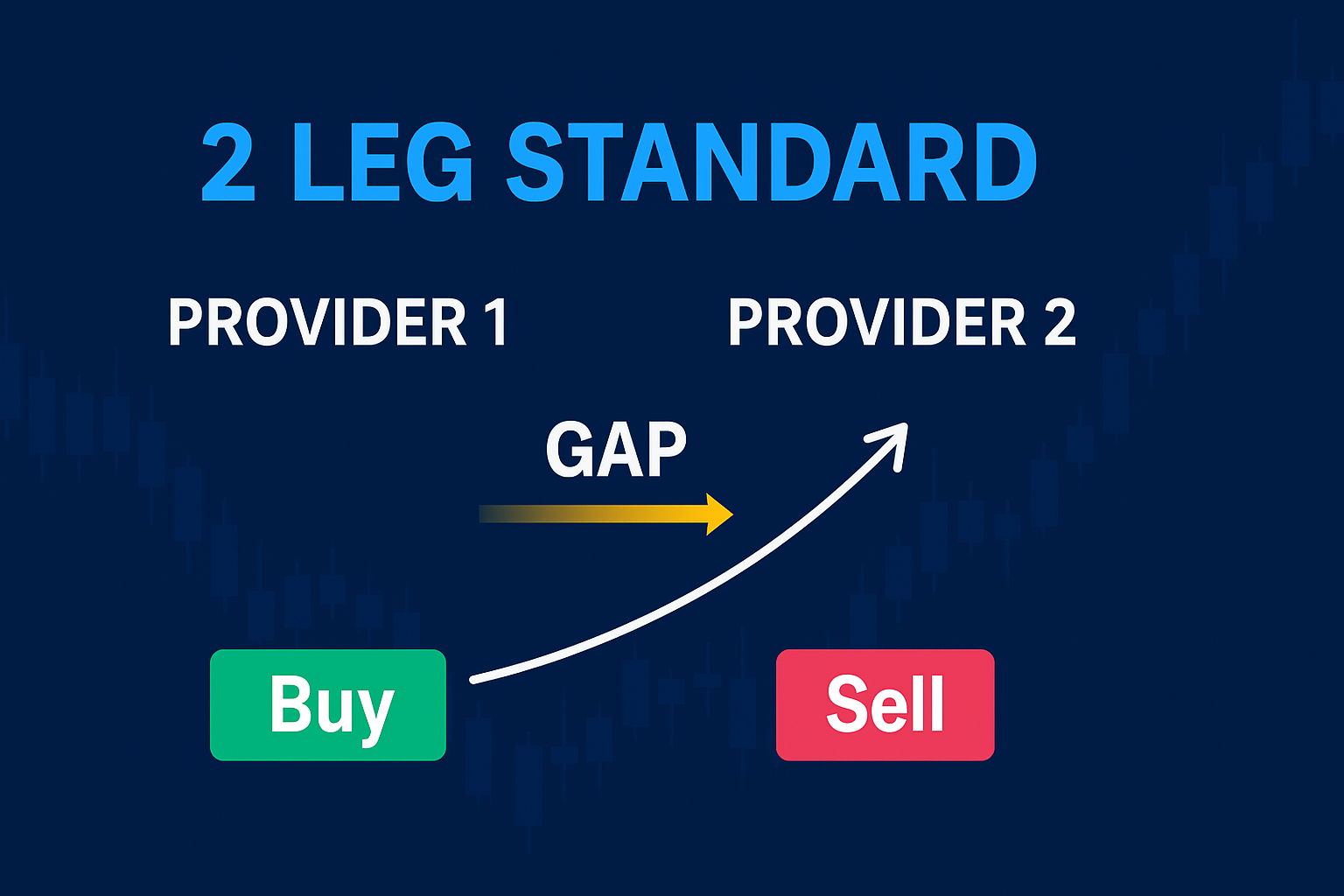

TwoLegStandard is Westernpips Private 7’s time‑tested arbitrage strategy designed to exploit short‑lived price discrepancies between two independent quote providers (typically two brokers or two connections to the same broker). Unlike one‑leg tactics, TwoLegStandard opens simultaneous Buy and Sell positions on the same symbol across two accounts, creating an instant hedge with zero market exposure at entry. The strategy then manages exit conditions to lock in profits as prices realign.

________________________________________

⚙️ How the Strategy Works

Dual Quotes – The algorithm streams Bid/Ask prices for the same instrument from Provider 1 and Provider 2.

Price Comparison – It compares these quotes, applying an optional auto‑ or manual shift to align the feeds.

Signal Detection – When a predefined threshold (OpenGapPt or OpenBasketPt) is exceeded, an entry signal is generated.

Hedged Entry – Two opposing trades are opened instantly:

• Buy on Account A (Provider 1)

• Sell on Account B (Provider 2)

Lock Mode – Both legs are held for at least MinLockDurationSecs to avoid noise‑based exits.

Smart Exit – Positions close when one of the following triggers fires:

• Take Profit (TP) – target profit from gap convergence

• Stop Loss (SL) – preset loss cap

• Close Gap – reverse price divergence

• Smart Close – TP adjusted for slippage________________________________________

🚀 Dual Entry Options: GAP & Basket

• Gap Arbitrage – Fires on instantaneous Bid/Ask divergence between providers.

• Basket Arbitrage – Uses a calculated profit spread (basket) based on initial vs. current quotes, ideal for calmer markets.________________________________________

🔐 Lock Mechanism

After entry, a mandatory hold (“Lock”) minimizes premature exits. TwoLegStandard also features a multi‑slot architecture, allowing multiple independent trades to run concurrently.

________________________________________

🎯 Key Benefits

✅ Pure arbitrage between two live quotes of the same instrument

✅ Instant hedged Buy/Sell execution on separate accounts

✅ Supports both Gap and Basket entry logic

✅ Flexible exits: TP, SL, Close Gap, Smart Close

✅ Auto or manual quote shift calibration

✅ Multi‑slot engine for parallel trading

✅ Works with FIX, MT4, MT5, cTrader connectors________________________________________

📈 Who Should Use TwoLegStandard?

This strategy is ideal for professional traders managing two brokerage accounts or quote feeds. It delivers hedged entries, intelligent trade management, and resilience in volatile conditions—perfect for:

Dual‑broker setups seeking latency edges

VPS or colocation deployments

Traders who demand refined signal filtering and risk control________________________________________

✅ Purpose

TwoLegStandard combines the reliability of classic two‑leg arbitrage with modern execution intelligence, letting you capitalize confidently on micro‑latency and fleeting market inefficiencies.

You must be logged in to reply to this topic.